The smart Trick of Hsmb Advisory Llc That Nobody is Discussing

Bureau of Labor Data, both spouses functioned and brought in income in 48. They would be likely to experience financial difficulty as a result of one of their wage income earners' deaths., or exclusive insurance coverage you purchase for yourself and your family by calling health and wellness insurance coverage business directly or going via a wellness insurance coverage agent.

2% of the American populace was without insurance coverage in 2021, the Centers for Condition Control (CDC) reported in its National Facility for Health Statistics. Greater than 60% obtained their coverage via an employer or in the exclusive insurance policy industry while the rest were covered by government-subsidized programs including Medicare and Medicaid, professionals' advantages programs, and the government market established under the Affordable Care Act.

Little Known Facts About Hsmb Advisory Llc.

If your revenue is low, you might be one of the 80 million Americans who are qualified for Medicaid.

According to the Social Security Administration, one in 4 workers going into the workforce will come to be impaired prior to they get to the age of retired life. While health insurance coverage pays for a hospital stay and medical costs, you are usually strained with all of the costs that your paycheck had actually covered.

Prior to you purchase, check out the small print. Lots of plans require a three-month waiting duration before the insurance coverage begins, supply an optimum of three years' well worth of insurance coverage, and have significant policy exemptions. Despite years of improvements in automobile safety, an approximated 31,785 individuals died in website traffic mishaps on united state

About Hsmb Advisory Llc

Comprehensive insurance covers theft and damage to your vehicle because of floodings, hail storm, fire, criminal damage, falling objects, and animal strikes. When you finance your Related Site automobile or rent a car, this kind of insurance is compulsory. Uninsured/underinsured vehicle driver () insurance coverage: If an uninsured or underinsured driver strikes your vehicle, this coverage spends for you and your guest's clinical costs and may likewise represent lost earnings or compensate for pain and suffering.

Company insurance coverage is typically the most effective option, however if that is inaccessible, get quotes from several suppliers as several offer discount rates if you acquire greater than one type of coverage. (https://www.twitch.tv/hsmbadvisory/about)

The 2-Minute Rule for Hsmb Advisory Llc

In between medical insurance, life insurance policy, disability, obligation, long-lasting, and also laptop insurance policy, the job of covering yourselfand thinking regarding the countless possibilities of what can happen in lifecan feel overwhelming. Once you understand the fundamentals and see to it you're properly covered, insurance coverage can boost financial confidence and wellness. Right here are the most essential kinds of insurance coverage you need and what they do, plus a couple tips to avoid overinsuring.

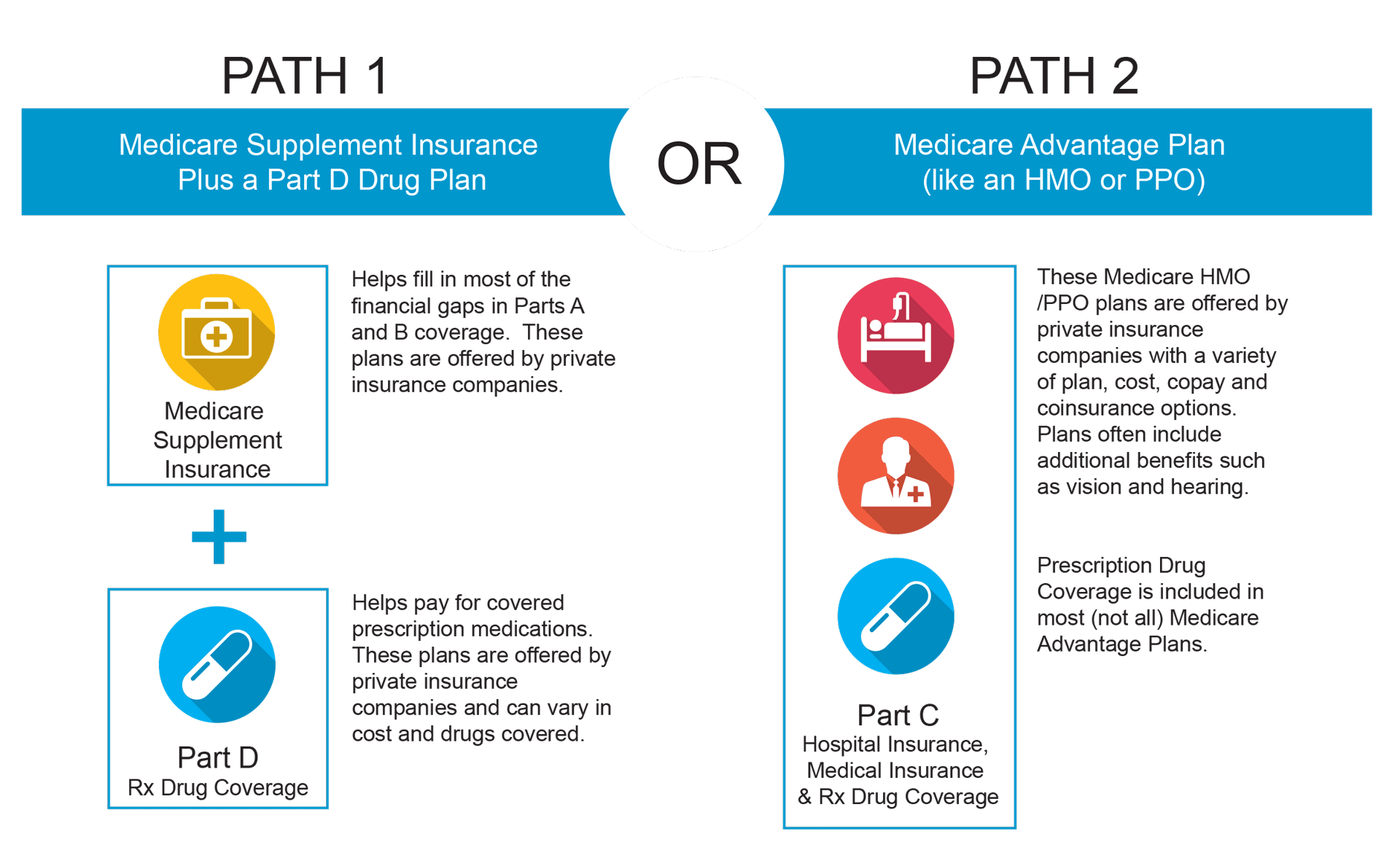

Various states have various laws, yet you can anticipate health insurance (which many individuals make it through their company), automobile insurance policy (if you have or drive a car), and house owners insurance policy (if you have building) to be on the checklist (https://hsmbadvisory.edublogs.org/2024/02/26/health-insurance-st-petersburg-fl-your-guide-to-comprehensive-coverage/). Necessary kinds of insurance can alter, so inspect up on the most up to date legislations every so often, particularly prior to you restore your plans

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-6451fde927474d4f8a81a5681efd393f.jpg)